Reshaping a Kazakhstan micro-finance service around customers and staff

Nov 2018 - Feb 2019

Whilst at Bristol agency cxpartners I led a UX team to Kazakhstan in 2018 to work with microfinance initiative (MFI), the Asian Credit Foundation (ACF) based in Almaty, 300 miles from the Mongolian border. ACFs mission is to deliver economic and social impact by providing financial opportunities to women in rural communities. Many of these ‘hard to reach’ communities are underserved by financial services. MFIs are an established way to deliver impactful interventions to targeted communities in emerging economies, which can help to increase income and improve standards of living.

What our client wanted and needed

Our client needed to improve their business to remain profitable and competitive in an increasingly competitive market (a bit more on this in a moment). This includes the need to respond to increased competition and defend against digitally disruptive entrants ring-fencing higher-value customers (in emerging economies this can further marginalise the poorest and least digitally and financially literate) and of course, improve service propositions whilst retaining customers and employees.

Our Kazakh client was keen to explore how a customer-centred approach might help them to achieve those goals. This was a bold, innovative move by their CEO who was breaking with the traditional accounting-based consulting models available to them – they soon saw the value and very tellingly told us : “until you arrived no visiting consultant has talked to us about how we run our business – they always spend days locked up with the accounts before telling us what we should do better” !

What MFIs do and how they do it

MFI schemes often leverage the strong sense of collective responsibility found in the rural villages of Africa and India from where MFI concepts emerged, and whilst Kazakhstan culture is quite different to these, Kazakh communities are strong and the social dynamics of collective obligation alive and well. But MFIs themselves do not run as not-for-profits, the model requires local organisations to be profitable - and it is that profitability that makes setting up these organisations attractive to local entrepreneurs. Throughout the value chain of MFI, ‘local’ is very important: local economics, local people, local knowledge and local business. The aim is to create economic and social impact that leads to change for good at a local level, rather than distributing profits elsewhere or outside of the country.

Business is tough in Kazakhstan

Being an MFI and staying profitable is tough. Financial businesses in Kazakhstan are tightly regulated and when I visited they were at position 130/180 on Transparency International's Corruption Perception Index (CPI), meaning that regulation needs to be strong and far-reaching (its getting better, Feb 21 and they are at 94/180 !). Making a profit lending to those considered non-lendable by others and doing so through very small loans (circa $1 - $200) requires a lean operation that builds upon a real understanding of very specific local lending risks and opportunities. In spite of thin margins and skinned-to-the-bone operations, the Kazakhstan MFI sector is very competitive - and that competition benefits those who do things better and more cheaply. Whilst digital is part of that, so is efficiency and product relevance. But tight constraints and a straightforward product mean differentiation is difficult, and as we have learnt in the West, under these circumstances - success falls to those who win on service and customer experience.

How we executed Discovery

We spent time with our clients’ business team in Almaty talking to HQ staff to understand the business and how it worked, and to expose some of the pressures and tensions experienced by staff. We ran (simultaneously translated) workshops with front line staff from all over the country with whom we created personas and mapped the lending-service and assumptively-mapped the needs and experiences of their customers with that service. Useful to get this geographic spread as there are significant differences in the needs of the Kazakhstan customer base according to geography (this is the largest land-locked country in the world).

We then moved out into the country-side (the Steppe) and visited the rural branches that worked day to day approving and distributing loans, where we talked with staff and also ran interviews with many (largely female) customers.

As expected, language and translators presented familiar challenges. But things were made more complex by the different status accorded natives speakers of the two dominant languages, Russian and Kazakh. In addition we had to manage the questionable respect accorded the frequently illiterate rural community by our city-dwelling translators. There’s a lot to tell, but to cut to the chase – business interviews and workshops in Almaty mediated by Russian translators went smoothly, whereas customer interviews in the countryside with Kazakh translators led us to innovate on the fly – we needed to ensure we were communicating what we wanted, and for some tasks took the translator out of the loop and used instead an improvised set of simple pictographics that customers could point at.

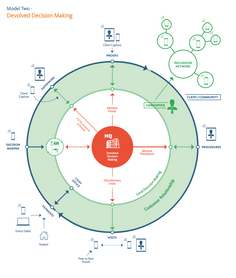

We found plenty of customer journey friction, and we also found employee journey friction. Either of these can be symptomatic of deeper organisational problems and it turned out that issues for both customers and front line staff derive from the same organisational problem - this was a command and control structure that centralises decision-making and procedure setting at HQ, and that couldn’t respond easily to feedback from customers and employees. Part of our reporting recommended a devolved decision-making model designed to flow decision making to those parts of the organisation who knew their customers best.

We also discovered many very immediate and actionable opportunities for ACF to improve their customer and employee experience and in so doing raise the quality and competitiveness of the service. From redesign of procedures and paper-work, to the physical environment of the branches and the products through to more nuanced factors that were hiding in clear sight – such as the antipathy generated by ACF officers visiting villages to check individual credit-worthiness, something that was done because it always had been, but also something that generated significant dissatisfaction amongst customers – we were able to propose a solution that used simple and free technology (WhatsApp) to circumvent this significant problem.

In Summary

Moving focus from a spreadsheet towards customers was refreshing for an organisation committed to delivering economic and social impact. Putting customers at the heart of the business showed ACF how to deliver value throughout the organisation and aligned their mission with the service they actually deliver - something that surprisingly can often be missing.

Our findings provided our client with journey maps (in Russian) and personas and proposals for organisational redesign that are grounded in the real experiences of their customers and employees – but most importantly we gave them a way to think more creatively and insightfully about their business and how to better serve customers organisational structures and service change.

I gave a couple of webinairs to an audience of international financial institutions interested in human centred design and UX, you can watch them here and here

“....until you arrived no visiting consultant had talked to us about how we run our business – they always spend days locked up with the accounts before telling us what we should do better”

CEO ACF Kazahstan